When it comes to building wealth for the future, picking the best Roth IRA investments is the key to maximizing tax-free growth and securing your retirement. 🚀 Unlike traditional IRAs, a Roth IRA lets your money grow tax-free, and you won’t have to pay taxes on withdrawals in retirement—a huge advantage! 💰

But with so many investment options, how do you choose the Roth IRA investments for your financial goals? 🤔 Whether you’re a beginner or an experienced investor, your choices should align with your risk tolerance, time horizon, and retirement strategy. Let’s explore the top investments that can help you grow your wealth efficiently! 💡🔥

What Makes a Good Roth IRA Investment?

Choosing the right investments for your Roth IRA is essential to maximizing tax-free growth and ensuring a secure financial future. Since Roth IRAs allow your money to grow tax-free, selecting investments that align with your goals, risk tolerance, and time horizon is crucial. Here’s what makes a good Roth IRA investment:

💰 Low Fees & Strong Historical Returns

One of the biggest factors in long-term investing success is minimizing fees. High fees can eat away at your returns, reducing the overall growth of your Roth IRA. Look for low-cost index funds, ETFs, and mutual funds with a proven track record of strong historical returns. For example, Vanguard and Fidelity offer low-cost index funds that have consistently outperformed many actively managed funds over time.

📊 Diversification & Risk Management

A well-balanced investment portfolio reduces risk while maximizing growth. Diversification means spreading your investments across different asset classes, such as stocks, bonds, and real estate, to protect your portfolio from market volatility. For young investors, a higher percentage in stocks can be beneficial, while those closer to retirement may prefer a mix of stocks and bonds for stability.

🚀 Growth Potential & Tax Efficiency

Since Roth IRAs grow tax-free, it’s wise to invest in assets with high growth potential, such as stocks, ETFs, and real estate investment trusts (REITs). Stocks, especially S&P 500 index funds, tend to offer higher long-term returns, making them one of the best Roth IRA investments.

👩🎓 Best Roth IRA Investments for Young Adults

Young investors have a long time horizon, allowing them to take advantage of compounding growth. Some of the best Roth IRA investments for young adults include:

✅ Growth Stocks – High-potential companies with strong earnings growth

✅ Index Funds & ETFs – Low-cost, diversified investments with solid returns

✅ Target-Date Funds – Adjust risk levels automatically as you approach retirement

✅ REITs – Invest in real estate without owning property

By selecting the right investments, you can maximize long-term growth and set yourself up for a comfortable retirement. 💡

Plan your retirement smarter ➤ Try Roth IRA Calculator now!

Best Roth IRA Investments for Beginners

If you’re just starting your Roth IRA investment journey, it’s crucial to select investments that offer a balance of growth, stability, and diversification. Below are some of the best Roth IRA investments for beginners, each offering strong long-term potential with manageable risk levels.

| Investment Type | Benefits | Examples |

|---|---|---|

| S&P 500 Index Funds | Low-cost, diversified, long-term growth | Vanguard S&P 500 ETF (VOO), Fidelity 500 Index Fund (FXAIX) |

| Dividend Stock Funds | Steady income, compounding returns, lower volatility | Vanguard Dividend Appreciation ETF (VIG), Schwab U.S. Dividend ETF (SCHD) |

| Value Stock Funds | Invest in undervalued companies with strong financials | Vanguard Value Index Fund (VVIAX), iShares Russell 1000 Value ETF (IWD) |

| Nasdaq-100 Index Funds | Exposure to high-growth tech companies | Invesco QQQ ETF (QQQ), Fidelity Nasdaq Composite Index Fund (FNCMX) |

| REIT Funds | Real estate exposure, passive income, high dividends | Vanguard Real Estate ETF (VNQ), iShares U.S. Real Estate ETF (IYR) |

| Target-Date Funds | Automatic asset allocation, hands-off investing | Vanguard Target Retirement 2050 (VFIFX), Fidelity Freedom Index 2050 (FIPFX) |

| Small-Cap Funds | High growth potential, ideal for young investors | Vanguard Small-Cap Index Fund (VSMAX), iShares Russell 2000 ETF (IWM) |

| Bond Funds | Lower risk, stability, steady income | Vanguard Total Bond Market ETF (BND), Fidelity U.S. Bond Index Fund (FXNAX) |

S&P 500 Index Funds – Low-Cost & Reliable Growth

S&P 500 index funds are among the Roth IRA investments for beginners because they provide exposure to 500 of the largest U.S. companies. These funds are low-cost, highly diversified, and have a strong historical track record of delivering 8-10% annual returns over the long term. Since these funds track the overall stock market, they offer steady growth without requiring constant monitoring.

🔹 Examples:

- Vanguard S&P 500 ETF (VOO)

- Fidelity 500 Index Fund (FXAIX)

- Schwab S&P 500 Index Fund (SWPPX)

Dividend Stock Funds – Steady Income & Compounding Growth

Dividend stock funds invest in companies that regularly pay dividends, providing passive income while allowing your investments to grow over time. These funds are great for beginners because dividends can be reinvested, leading to compounding returns. They are also less volatile than growth stocks, making them a stable choice for long-term investors.

🔹 Examples:

- Vanguard Dividend Appreciation ETF (VIG)

- Schwab U.S. Dividend Equity ETF (SCHD)

- Fidelity Dividend Growth Fund (FDGFX)

Value Stock Funds – Investing in Undervalued Companies

Value stock funds focus on undervalued stocks that are expected to grow over time. These stocks typically belong to companies with strong financials but are trading below their intrinsic value. Since value stocks tend to be less volatile than high-growth stocks, they provide a safer investment option for beginners.

🔹 Examples:

- Vanguard Value Index Fund (VVIAX)

- Schwab Fundamental US Large Company Index ETF (FNDX)

- iShares Russell 1000 Value ETF (IWD)

Nasdaq-100 Index Funds – High-Growth Tech Investments

Nasdaq-100 index funds provide exposure to 100 of the largest non-financial companies listed on the Nasdaq, including big tech giants like Apple, Microsoft, and Amazon. While these funds are more growth-focused and volatile, they offer huge potential for long-term gains, making them one of the best Roth IRA investments for young adults who can handle some risk.

🔹 Examples:

- Invesco QQQ ETF (QQQ)

- Fidelity Nasdaq Composite Index Fund (FNCMX)

- iShares Nasdaq 100 ETF (QQQM)

REIT Funds (Real Estate Investment Trusts) – Real Estate Exposure Without Buying Property

REITs are an excellent way for beginners to invest in real estate without owning physical property. These funds generate income from rental properties, commercial buildings, and other real estate investments, making them a great source of passive income. Since REITs are required to distribute 90% of their income as dividends, they are a solid choice for income-focused investors.

🔹 Examples:

- Vanguard Real Estate ETF (VNQ)

- Schwab U.S. REIT ETF (SCHH)

- iShares U.S. Real Estate ETF (IYR)

Target-Date Funds – Set-It-and-Forget-It Investing

Target-date funds are perfect for beginners because they automatically adjust your investment mix as you get closer to retirement. These funds start with more stocks for growth and gradually shift towards bonds and other stable investments over time. This hands-off approach makes them ideal for those who don’t want to actively manage their portfolio.

🔹 Examples:

- Vanguard Target Retirement 2050 Fund (VFIFX)

- Fidelity Freedom Index 2050 Fund (FIPFX)

- T. Rowe Price Retirement 2050 Fund (TRRMX)

Small-Cap Funds – High Growth Potential with Some Risk

Small-cap funds invest in smaller, fast-growing companies, which tend to offer higher returns but come with more volatility. These funds are great for young investors who have a long time horizon and can tolerate short-term market fluctuations in exchange for higher growth potential.

🔹 Examples:

- Vanguard Small-Cap Index Fund (VSMAX)

- iShares Russell 2000 ETF (IWM)

- Schwab U.S. Small-Cap ETF (SCHA)

Bond Funds – Stability & Lower Risk

Bond funds are a safer investment option, making them great for conservative investors or those nearing retirement. They provide steady income and help reduce risk in a portfolio by acting as a buffer during market downturns. While bond funds don’t offer as high returns as stocks, they protect your capital and ensure stability.

🔹 Examples:

- Vanguard Total Bond Market ETF (BND)

- iShares U.S. Treasury Bond ETF (GOVT)

- Fidelity U.S. Bond Index Fund (FXNAX)

By choosing a mix of these investments, beginners can build a diverse and well-balanced Roth IRA portfolio that maximizes long-term growth while minimizing risk. 🚀

See how your Roth IRA grows ➤ Calculate your potential returns!

Best Roth IRA Investments by Brokerage

Not all brokerages offer the same benefits when it comes to Roth IRA investments. The right choice depends on factors like fees, investment options, and user experience. Below, we break down the Roth IRA investments available at top brokerages like Fidelity, Vanguard, Charles Schwab, and Robinhood.

| Brokerage | Top Investments | Why Choose Them? |

|---|---|---|

| Fidelity |

– Fidelity 500 Index Fund (FXAIX) – Fidelity ZERO Large Cap Index Fund (FNILX) |

✅ Zero expense ratio funds ✅ No account fees or minimums |

| Vanguard |

– Vanguard S&P 500 ETF (VOO) – Vanguard Total Stock Market Index Fund (VTSAX) |

✅ Low-cost index investing ✅ Best for long-term growth |

| Charles Schwab |

– Schwab S&P 500 Index Fund (SWPPX) – Schwab U.S. Dividend Equity ETF (SCHD) |

✅ No fees on Schwab ETFs ✅ Strong customer support |

| Robinhood |

– Invesco QQQ ETF (QQQ) – SPDR S&P 500 ETF (SPY) |

✅ Zero-commission trades ✅ User-friendly mobile app |

Best Roth IRA Investments – Fidelity

Fidelity is a top choice for low-cost investing with a wide range of mutual funds and ETFs tailored for Roth IRAs. Beginners and experienced investors alike benefit from zero expense ratio index funds and commission-free trades.

✅ Top Fidelity Roth IRA Investments:

- Fidelity ZERO Large Cap Index Fund (FNILX) – Zero expense ratio, tracks large-cap U.S. stocks.

- Fidelity 500 Index Fund (FXAIX) – A low-cost alternative to the S&P 500.

- Fidelity U.S. Bond Index Fund (FXNAX) – A great bond option for stability.

📌 Why Choose Fidelity?

✔ No account fees or minimums 📉

✔ A variety of low-cost index funds 🏦

✔ Great research tools for investors 📊

Best Roth IRA Investments – Vanguard

Vanguard is the gold standard for long-term investing, offering a vast selection of low-cost index funds. It’s ideal for passive investors who want to grow wealth over decades.

✅ Top Vanguard Roth IRA Investments:

- Vanguard S&P 500 ETF (VOO) – A low-cost way to track the S&P 500.

- Vanguard Total Stock Market Index Fund (VTSAX) – Diversified exposure to the entire U.S. stock market.

- Vanguard Target Retirement 2050 Fund (VFIFX) – A hands-off, automatically adjusting fund.

📌 Why Choose Vanguard?

✔ Industry-leading low expense ratios 💰

✔ Best for long-term, passive investors 🕰

✔ Wide selection of index funds & ETFs 📈

Best Roth IRA Investments – Charles Schwab

Schwab is a fantastic brokerage for beginner and active investors, offering commission-free ETFs and mutual funds. It also provides robo-advisory services for those who prefer automated investing.

✅ Top Schwab Roth IRA Investments:

- Schwab S&P 500 Index Fund (SWPPX) – One of the lowest-cost S&P 500 funds.

- Schwab U.S. Dividend Equity ETF (SCHD) – A top choice for dividend investors.

- Schwab Intelligent Portfolios – A robo-advisor that automatically manages your investments.

📌 Why Choose Schwab?

✔ No fees on Schwab ETFs & mutual funds 🏦

✔ Great customer support & investor tools 🤝

✔ Robo-advisory for automated investing 🤖

Best Roth IRA Investments – Robinhood

Robinhood is best known for commission-free stock and ETF trading, making it popular among young investors. However, it’s important to be cautious about active trading within a Roth IRA, as frequent trading could reduce long-term gains.

✅ Top Robinhood Roth IRA Investments:

- Invesco QQQ ETF (QQQ) – Tracks the Nasdaq-100, offering exposure to tech giants.

- SPDR S&P 500 ETF (SPY) – A well-known S&P 500 ETF with high liquidity.

- iShares Russell 2000 ETF (IWM) – Provides exposure to small-cap growth stocks.

📌 Why Choose Robinhood?

✔ Zero-commission trading on stocks & ETFs 💲

✔ User-friendly mobile app for easy investing 📱

✔ Instant deposits for fast trades ⚡

⚠ Risks to Consider:

🚨 Robinhood encourages frequent trading, which can be risky for long-term investing.

🚨 It lacks access to mutual funds and some advanced investment tools.

How much will your Roth IRA be worth? ➤ Calculate in seconds!

Where to Open a Roth IRA for Investment Growth?

Choosing the best place to open a Roth IRA is just as important as selecting the right investments. A good brokerage should offer low fees, strong investment options, and user-friendly platforms to help your money grow efficiently. Below, we compare some of the top choices:

Best Roth IRA Accounts for Beginners

If you’re new to investing, you’ll want a Roth IRA provider that offers:

✅ Low or zero account fees

✅ Commission-free trades

✅ Automated investment options

✅ A variety of investment choices

Some of the best places to open a Roth IRA include:

- Fidelity – Best for low-cost index funds & research tools

- Vanguard – Best for long-term passive investing

- Charles Schwab – Best for commission-free ETFs & customer support

- Robinhood – Best for active traders & no minimum deposit

Comparing Fidelity, Vanguard, Schwab, and Robinhood

Each brokerage offers unique advantages based on your investment style and goals:

| Brokerage | Best For | Pros | Cons |

|---|---|---|---|

| Fidelity | Low-cost index funds | ✅ Zero expense ratio funds ✅ No account fees |

❌ Fewer robo-advisor options |

| Vanguard | Long-term passive investing | ✅ Industry-leading ETFs ✅ Low expense ratios |

❌ Higher minimums for some funds |

| Charles Schwab | Commission-free ETFs | ✅ Excellent customer support ✅ Wide range of investment choices |

❌ Some mutual funds have transaction fees |

| Robinhood | Active trading | ✅ Zero-commission trades ✅ Easy-to-use mobile app |

❌ Limited retirement planning tools |

💡 Pro Tip: If you’re looking for hands-off investing, consider Vanguard or Fidelity. If you prefer active trading, Robinhood might be a better fit.

By choosing the right Roth IRA provider, you can set yourself up for long-term investment growth and financial security. 🚀

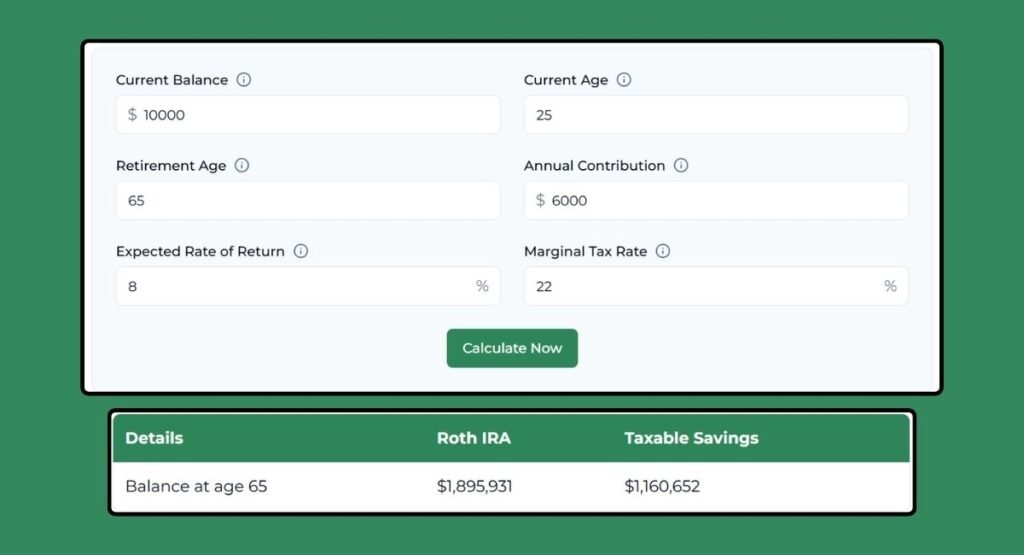

Maximize Your Savings with Roth IRA Calculator!

Wondering how much your Roth IRA investments could grow over time? Our Roth IRA Calculator helps you estimate your tax-free retirement savings based on your contributions, expected returns, and investment period.

Whether you’re a beginner or an experienced investor, this tool makes planning easy! Simply enter your details and get a clear picture of your potential long-term wealth. Start optimizing your Roth IRA strategy today and make informed investment decisions.

👉 Try our Roth IRA Calculator now and take control of your financial future! 🚀

FAQs 🤔

What is the safest investment for a Roth IRA?

The safest investments for a Roth IRA are bond funds, Treasury securities, and money market funds. These options provide low risk and steady returns, making them ideal for conservative investors. However, their growth potential is lower compared to stocks and ETFs.

Can I invest in real estate in my Roth IRA?

Yes! You can invest in real estate through a self-directed Roth IRA (SDIRA). This allows you to hold rental properties, land, REITs, and real estate funds. However, managing real estate in a Roth IRA comes with strict IRS regulations, so it’s essential to work with an experienced custodian.

How much should I invest in my Roth IRA each year?

For 2025, the maximum contribution limit is $7,000 ($8,000 if you’re 50 or older). It’s a good idea to maximize contributions each year to take full advantage of tax-free growth. If you can’t invest the full amount, aim to contribute at least what you can consistently.

Are stocks or ETFs better for a Roth IRA?

Both stocks and ETFs have their advantages.

- ETFs provide instant diversification, making them a solid choice for beginners.

- Individual stocks offer higher growth potential, but they require research and carry more risk.

Many investors choose a mix of both for balanced long-term growth.

Don’t miss this! ➤ Best Roth IRA Accounts for Beginners 2025

Conclusion

Choosing the best Roth IRA investments is crucial for building long-term wealth and securing a comfortable retirement. Whether you’re a beginner, young investor, or experienced trader, picking the right mix of index funds, ETFs, and dividend stocks can set you up for success.

💡 Final Thoughts:

✅ Invest consistently to maximize growth

✅ Focus on low-cost, high-growth assets

✅ Choose a brokerage that aligns with your needs

Start investing wisely today, and let your Roth IRA work for you! 🎯