Roth IRA Calculator – The Ultimate Tool for Smart Retirement Planning

Planning for retirement might seem overwhelming, but it doesn’t have to be. A Roth IRA (Individual Retirement Account) is one of the smartest ways to secure a financially stable future while enjoying tax-free withdrawals in retirement. But how do you know how much to contribute, how your investments will grow, and what your tax advantages will look like? That’s where a Roth IRA Calculator comes in.

This powerful tool helps you estimate your future retirement savings based on your contributions, expected growth, and withdrawal strategy. Instead of guessing, you can use real numbers to make informed financial decisions today that will benefit you in the long run.

Key Benefits of a Roth IRA

✅ Tax-Free Growth & Withdrawals

One of the biggest advantages is that your investments grow tax-free, and you can withdraw both your contributions and earnings completely tax-free in retirement. This makes it an excellent long-term strategy for maximizing wealth.

✅ No Required Minimum Distributions (RMDs)

Traditional IRAs force you to start withdrawing money at age 73 (as of 2023), but a Roth IRA has no RMDs. This means you can let your money grow for as long as you like, giving you more control over your retirement savings.

✅ Flexible Withdrawals

Unlike other retirement accounts, you can withdraw your contributions (but not your earnings) at any time without penalties. This flexibility makes a Roth IRA a great option for both retirement and emergency savings.

✅ Estate Planning Advantages

A Roth IRA can be passed down to your heirs tax-free, allowing your loved ones to benefit from tax-free growth even after you’re gone. This makes it a smart choice for wealth transfer and legacy planning.

✅ Protection Against Future Tax Increases

Since tax laws can change, locking in today’s tax rates by contributing to a Roth IRA shields you from future tax hikes. Your withdrawals remain tax-free, no matter how high taxes go in the future.

A Roth IRA is more than just a retirement account—it’s a long-term wealth-building strategy that offers financial security, tax advantages, and flexibility.

The Importance of Using a Roth IRA Calculator

While a Roth IRA is an excellent investment vehicle, figuring out the numbers on your own can be tricky. That’s where our roth ira estimator comes in handy.

✅ See Your Future Savings – Estimate how much you’ll have in your Roth IRA by retirement.

✅ Adjust Your Contributions – Find the perfect contribution amount to maximize your savings.

✅ Compare Scenarios – See how different growth rates, income levels, and contribution strategies impact your retirement fund.

✅ Plan Withdrawals Smartly – Get an idea of how much you can withdraw tax-free at different ages.

Instead of making blind financial decisions, our calculator provides clear projections, helping you stay on track toward a comfortable retirement.

Don’t Miss ➤ Best Roth IRA Accounts

How Does a Roth IRA Work?

A Roth IRA is one of the most tax-efficient ways to save for retirement, but how does it actually work? In simple terms, you contribute after-tax income, your money grows tax-free, and when you retire, you can withdraw your savings without paying any taxes—as long as you follow the rules.

Let’s break it down step by step.

Contributions and Income Limits

Before you start investing in a Roth IRA, you need to know the contribution limits and income eligibility requirements set by the IRS.

1. How Much Can You Contribute?

For 2024, the maximum annual contribution limits are:

💰 $7,000 if you’re under 50 years old

💰 $8,000 if you’re 50 or older (includes a $1,000 “catch-up” contribution)

These limits apply per person, not per account. That means if you have multiple Roth IRAs, your total contributions across all accounts cannot exceed the annual limit.

2. Are You Eligible? (Income Limits)

Not everyone can contribute to a Roth IRA—you need to meet certain Modified Adjusted Gross Income (MAGI) limits.

Roth IRA Contribution Limits (Tax Year 2025)

| Single Filers (MAGI) | Married Filing Jointly (MAGI) | Married Filing Separately (MAGI) | Maximum Contribution for individuals under age 50 | Maximum Contribution for individuals age 50 and older |

| under $150,00 | under $236,000 | $0 | $7,000 | $8,000 |

| $151,500 | $237,000 | $1,000 | $6,300 | $7,200 |

| $153,000 | $238,000 | $2,000 | $5,600 | $6,400 |

| $154,500 | $239,000 | $3,000 | $4,900 | $5,600 |

| $156,000 | $240,000 | $4,000 | $4,200 | $4,800 |

| $157,500 | $241,000 | $5,000 | $3,500 | $4,000 |

| $159,000 | $242,000 | $6,000 | $2,800 | $3,200 |

| $160,500 | $243,000 | $7,000 | $2,100 | $2,400 |

| $162,000 | $244,000 | $8,000 | $1,400 | $1,600 |

| $163,500 | $245,000 | $9,000 | $700 | $800 |

| $165,000 & over | $246,000 & over | $10,000 & over | $0 | $0 |

Tax-Free Growth and Withdrawals

One of the biggest advantages of a Roth IRA is that your investments grow tax-free. Unlike traditional IRAs, where you pay taxes on withdrawals, a Roth IRA allows you to keep every dollar you earn.

1. How Does Tax-Free Growth Work?

- Once you contribute to a Roth IRA, you can invest your money in stocks, bonds, ETFs, mutual funds, real estate, and more.

- Your investments grow without being taxed year after year.

- Because you’ve already paid taxes on your contributions, you never have to pay taxes again on the growth.

Imagine this: If you contribute $6,000 per year for 30 years and earn an average 8% return, your Roth IRA could grow to over $680,000—and you won’t owe a single penny in taxes on it! 🎉

2. Tax-Free Withdrawals (The 5-Year Rule)

You can withdraw your contributions at any time without penalties. However, to withdraw earnings tax-free, you must meet two key rules:

✔️ Be at least 59½ years old

✔️ Have had your Roth IRA for at least 5 years (the “5-Year Rule”)

If you withdraw earnings before meeting these rules, you may face income taxes and a 10% penalty, except in special cases like:

✅ First-time home purchase (up to $10,000)

✅ Higher education expenses

✅ Disability or death

A Roth IRA provides both tax-free growth and tax-free withdrawals, making it a powerful tool for long-term financial security.

Why You Need a Roth IRA Calculator

Planning for retirement can feel overwhelming—how much should you save? What will your investments be worth in the future? How will taxes impact your withdrawals? This is where a roth ira estimator becomes a game-changer.

Instead of guessing, a roth ira estimator gives you clear, data-driven insights to make smarter financial decisions. Let’s explore how it simplifies retirement planning and the key factors it takes into account.

How It Simplifies Retirement Planning

A Roth IRA Calculator helps you see the big picture of your retirement savings by providing instant answers to key questions:

✔️ How much will my Roth IRA be worth in the future?

✔️ How much should I contribute each year to reach my retirement goals?

✔️ How do different rates of return impact my savings?

✔️ What happens if I adjust my contributions?

✔️ How does my age and investment strategy affect my final balance?

Instead of spending hours crunching numbers manually, our calculator does the math for you—quickly and accurately!

🔹 Example: Let’s say you invest $6,000 per year in a Roth IRA and earn an 8% average annual return. The calculator will show you exactly how much your account will be worth at retirement, helping you make informed savings decisions.

Don’t Miss ➤ Best Roth IRA Accounts

Key Factors the Calculator Considers

A high-quality calculator takes multiple factors into account to give you the most accurate and personalized projections. Here’s what it considers:

1. Contribution Amounts

💰 How much are you contributing each year?

The more you contribute, the faster your savings grow. The calculator factors in annual limits (e.g., $7,000 for 2024) and any catch-up contributions if you’re 50 or older.

2. Investment Growth Rate

📈 What is your expected rate of return?

The calculator estimates your long-term investment growth based on historical market performance. You can adjust this rate (e.g., 6%, 8%, or 10%) to see different potential outcomes.

3. Time Horizon (Years Until Retirement)

🕰️ How long do you plan to invest?

The longer your money stays invested, the more compound interest works in your favor. A roth ira estimator projects how your balance will grow over decades based on your age and retirement goals.

4. Inflation Adjustments

📉 How will inflation impact your savings?

A smart calculator factors in inflation, helping you understand the true value of your savings in future dollars. This ensures you’re saving enough to maintain your lifestyle in retirement.

5. Withdrawal Timing & Tax Benefits

🚀 When and how will you withdraw your funds?

Because Roth IRA withdrawals are tax-free in retirement, the calculator accounts for 0% tax on qualified withdrawals, helping you see how much of your money you get to keep.

How to Use Our Roth IRA Calculator

Planning your retirement has never been easier! Our calculator helps you estimate how much your investments will grow over time, allowing you to make informed financial decisions. Follow this step-by-step guide to use the tool effectively.

Step-by-Step Guide to Using the Roth IRA Estimator

1. Enter Your Current Balance

💰 This is the amount you already have in your Roth IRA account.

✅ Valid Range: Between $100 and $5,000,000

Example: If you’ve already saved $20,000, enter 20,000 in this field.

2. Input Your Current Age

🎂 This helps the calculator determine how many years your money will compound before retirement.

✅ Valid Range: Between 10 and 90 years old

Example: If you are 30 years old, enter 30.

3. Set Your Retirement Age

🏖️ This is the age when you plan to start withdrawing funds from your Roth IRA.

✅ Valid Range: Between your current age and 90

Example: If you want to retire at 50, enter 50.

4. Enter Your Annual Contribution

📆 This is how much you plan to contribute each year.

✅ For 2025:

- If you are under 50, you can contribute up to $7,000 per year.

- If you are 50 or older, the limit increases to $8,000 per year.

Example: If you don’t plan to contribute any more money, enter $0. If you plan to contribute $6,000 per year, enter 6,000.

5. Set Your Expected Rate of Return

📈 This is the annual return you expect from your investments.

✅ Valid Range: Between 0% and 20%

💡 Tip: The stock market has historically provided an average return of 7-8% annually after inflation.

Example: If you expect a 6% return, enter 6.

6. Input Your Marginal Tax Rate

💵 This is your current tax bracket percentage, which helps estimate the tax savings of using a Roth IRA.

✅ Valid Range: Between 0% and 50%

Example: If your marginal tax rate is 25%, enter 25.

7. Click ‘Calculate Now’

🎯 Once you’ve filled out all the fields, hit the green button to see your results!

🚀 The calculator will generate a detailed projection of your future Roth IRA balance based on your inputs.

Example Scenarios for Better Understanding

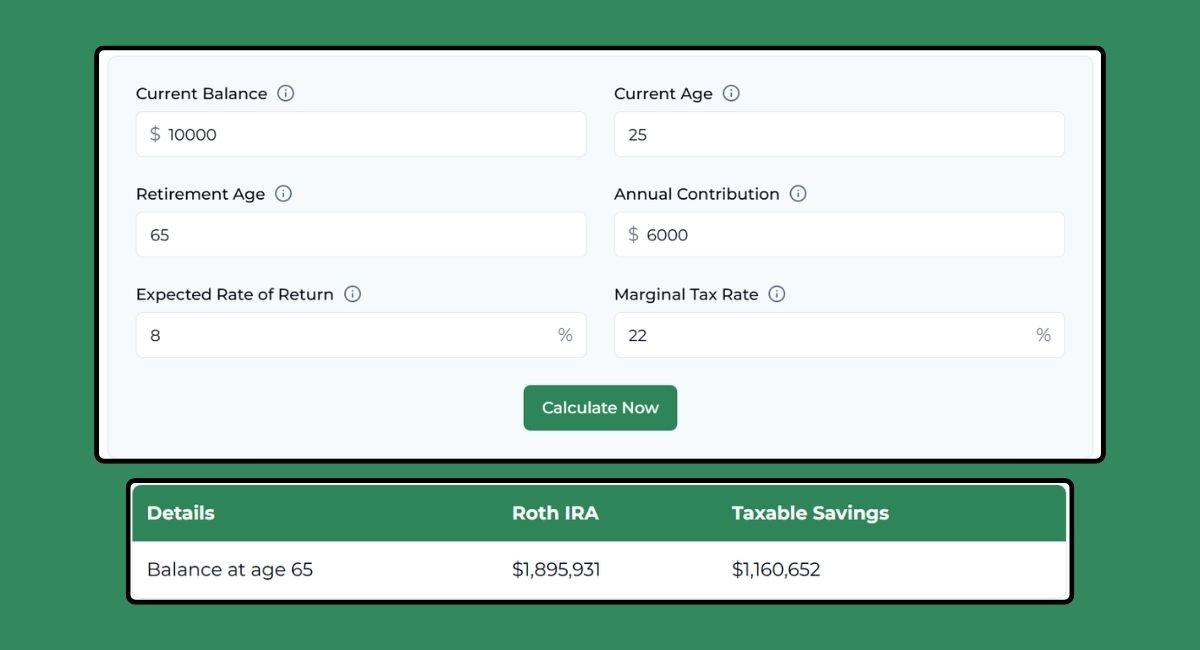

Young Investor Starting Early

- Current Balance: $10,000

- Current Age: 25

- Retirement Age: 65

- Annual Contribution: $6,000

- Expected Rate of Return: 8%

- Marginal Tax Rate: 22%

📊 Estimated Roth IRA Balance at Retirement: ~$1,895,931

💡 Takeaway: Starting early and contributing regularly leads to significant growth due to compound interest.

Using our roth retirement calculator, you can visualize your retirement savings growth and make informed decisions. Try it now and see how much your Roth IRA can grow!

Don’t Miss ➤ Best Roth IRA Accounts

Roth IRA vs. Traditional IRA – What’s the Difference?

When planning for retirement, choosing between a Roth IRA and a Traditional IRA is a crucial decision. While both accounts offer tax advantages, they differ in how and when you pay taxes. Below is a side-by-side comparison to help you decide which option is best for you.

Side-by-Side Comparison of Tax Treatment

| Feature | Roth IRA 🌟 | Traditional IRA 🏛️ |

|---|---|---|

| Tax Treatment | Contributions are after-tax (no tax deduction). | Contributions are pre-tax (tax-deductible). |

| Tax on Growth | Grows tax-free. | Grows tax-deferred (taxed upon withdrawal). |

| Withdrawals in Retirement | 100% tax-free if conditions are met. | Taxed as ordinary income. |

| Required Minimum Distributions (RMDs) | ❌ No RMDs – you can keep growing your money. | ✅ RMDs start at age 73. |

| Early Withdrawal Rules | Contributions can be withdrawn anytime tax-free. | Early withdrawals before 59½ may incur a 10% penalty + income tax. |

| Income Limits to Contribute (2025) | Yes, based on Modified Adjusted Gross Income (MAGI). | No income limits to contribute. |

Which Option Is Best for You?

Choosing between a Roth IRA and a Traditional IRA depends on your current income, future tax expectations, and retirement goals.

✅ A Roth IRA is best if:

✔️ You expect to be in a higher tax bracket in retirement.

✔️ You want tax-free withdrawals in the future.

✔️ You prefer no RMDs (more flexibility in retirement).

✔️ You’re young and just starting out, allowing decades for tax-free growth.

✅ A Traditional IRA is best if:

✔️ You want a tax deduction now to lower your taxable income.

✔️ You expect to be in a lower tax bracket in retirement.

✔️ You don’t mind paying taxes when you withdraw.

✔️ You don’t qualify for a Roth IRA due to income limits.

Key Takeaway

- If you want tax-free withdrawals in retirement, go with a Roth IRA.

- If you want tax savings now, a Traditional IRA is a better fit.

💡 Still unsure? Use our Roth Calculator to see how each option affects your retirement savings!

FAQs

1. What is the maximum income limit for a Roth IRA?

For 2025, the income limits for Roth IRA contributions depend on Modified Adjusted Gross Income (MAGI):

- Single filers: Phase-out begins at $146,000, and no contributions above $161,000.

- Married filing jointly: Phase-out starts at $230,000, and no contributions above $240,000.

If your income exceeds the limit, you can consider a Backdoor Roth IRA.

2. Can I withdraw money from my Roth IRA before retirement?

Yes, you can withdraw your contributions anytime tax-free and penalty-free. However, withdrawing earnings before age 59½ (and before the account is 5 years old) may result in taxes and a 10% penalty, unless you qualify for exceptions like first-time home purchase, education expenses, or disability.

3. How often should I use a Roth IRA Estimator?

You should use a roth retirement calculator at least once a year to track progress and adjust your contributions. It’s also useful when:

- Your income changes significantly.

- You change your contribution amount.

- Stock market conditions shift, affecting expected returns.

- You modify your retirement age or goals.

4. Does the IRA Calculator include inflation adjustments?

Most basic calculators do not include inflation adjustments. However, to get a realistic retirement projection, you should manually adjust the expected rate of return by considering inflation. The historical stock market return after inflation is around 7-8% annually. Always factor in inflation’s impact on your purchasing power.

5. What happens if I contribute more than the limit?

If you contribute more than the allowed limit, the IRS imposes a 6% penalty on the excess amount every year it remains in your account. To avoid penalties:

- Withdraw excess contributions before the tax filing deadline.

- Apply the excess toward next year’s contributions (if eligible).

- Consult a tax professional if unsure.

Conclusion

A Roth IRA is a powerful tool for building tax-free retirement wealth, and using a calculator ensures smart financial planning. By inputting key details like current balance, contributions, expected returns, and tax rates, you get a clear projection of your retirement savings.

Whether you’re comparing it to a Traditional IRA or optimizing contributions, this tool simplifies decision-making. Regularly reviewing your Roth IRA strategy helps you stay on track and maximize long-term gains. Start planning today and take control of your financial future with our easy-to-use Roth IRA Calculator! 😊